[ad_1]

Paying much more to get even much less. Exactly what American customers want essentially the most in these making an attempt instances.

By Wolf Richter for WOLF STREET.

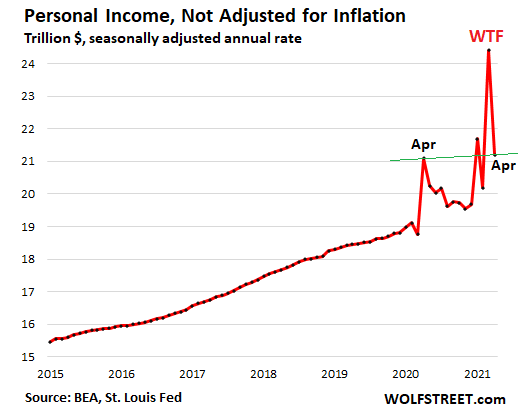

So we’ve received slightly scenario right here. We’ve received slightly bitty inflation uptick, I imply the worst inflation spike in three decades, and now complete private revenue from all sources, together with from the now fading free-money-from-the-sky stimmies, rose 0.5% in April in comparison with April a yr in the past; however adjusted for inflation, “real personal income,” fell 3.0% year-over-year, in response to the Bureau of Economic Analysis on Friday.

Month-over-month, and never adjusted for inflation, private revenue from all sources plunged 13% in April from March to a seasonally adjusted annual charge of $21.2 trillion – after having spiked by 21% in March for a stimmie-powered historic WTF second. Every one of the three waves of stimmies triggered a wonderful overshoot. So going ahead, most of these stimmies have been obtained and accounted for.

I indicated the 0.5% year-over-year improve in complete private revenue from all sources, not adjusted for inflation, with the upward-sloping inexperienced line. In a second, we’ll get to what that inexperienced line seems to be like adjusted for inflation.

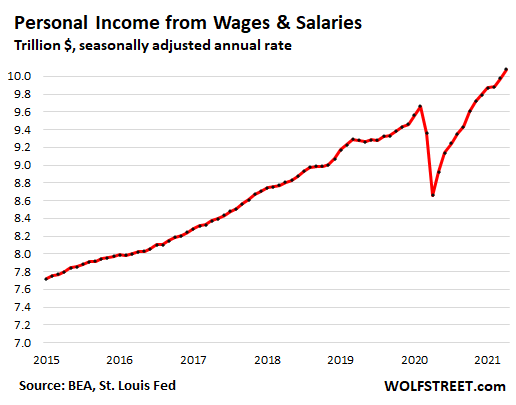

Personal revenue simply from wages and salaries, not adjusted for inflation, rose 1.0% in April, from March, and can seemingly improve additional in May, as extra customers re-enter the workforce and as employers elevate wages with a view to entice these folks again into the workforce, in what’s one of the weirdest labor markets ever, with record job openings, whereas 16 million persons are nonetheless claiming state or federal unemployment compensation.

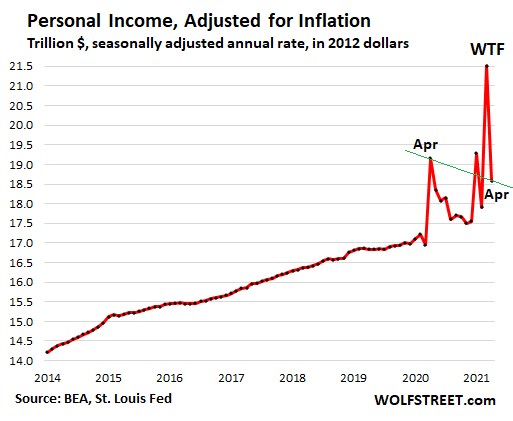

But then there’s inflation, and thereby the erosion of the buying energy of “real” private revenue. Total “real” private revenue from all sources — adjusted for inflation and expressed in chained 2012 {dollars} – in response to the Bureau of Economic Analysis, fell by 3.0% year-over-year – therefore the downward-sloping inexperienced line:

Yup, inflation – the decline of the buying energy of the greenback, and thereby the decline of the buying energy of labor – is precisely what the American shopper wants essentially the most in these making an attempt instances.

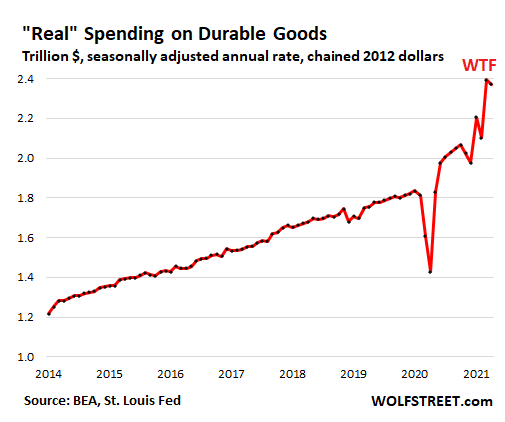

Nevertheless, American customers gave their darndest to carry up the worldwide economic system. In March, shopper spending on sturdy and nondurable items had carried out a stimmie-driven WTF spike of historic proportions, triggering record trade deficits as many of these items or their elements and supplies are imported. But spending on companies was nonetheless lagging woefully behind.

In April, some customers nonetheless received their stimmies and spent them, and different customers had been spending the stimmies that they’d gotten in March, and total spending in April held up close to the WTF degree in March. But what we’re now seeing too is the influence of inflation.

March and April had been the primary two months back-to-back in three a long time the place large-scale inflation has cropped up within the knowledge. So it’s time to see how that labored out.

“Real” spending on sturdy items dropped by 0.9% in April from March. But not-adjusted for inflation, it rose 0.5%. This contains the mega price increases in used and new vehicles.

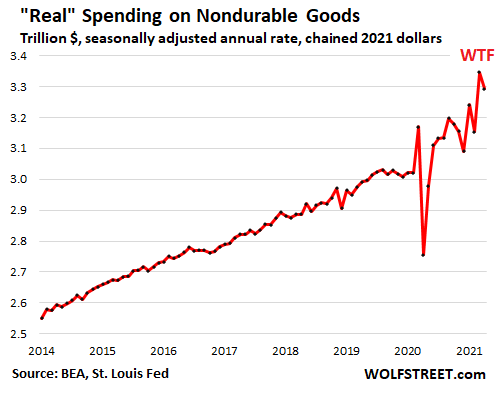

“Real” spending on nondurable items dropped 1.6% in April from March. Not-adjusted for inflation, it dropped 1.3%.

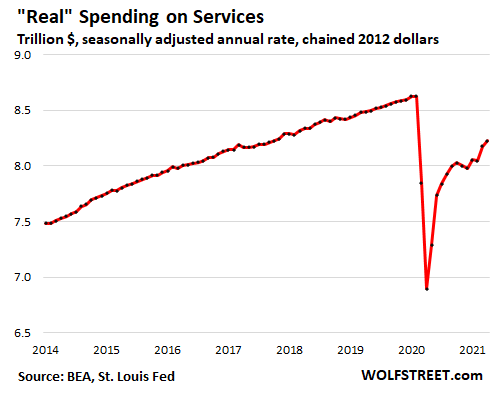

“Real” spending on companies ticked up 0.6% in April from March. But not-adjusted for inflation, it rose 1.1%. While spending on items has spiked to historic highs, spending on companies – from airline tickets and lodge bookings to lease – has lagged behind. In April, actual spending on companies was about the place it had been in late 2017.

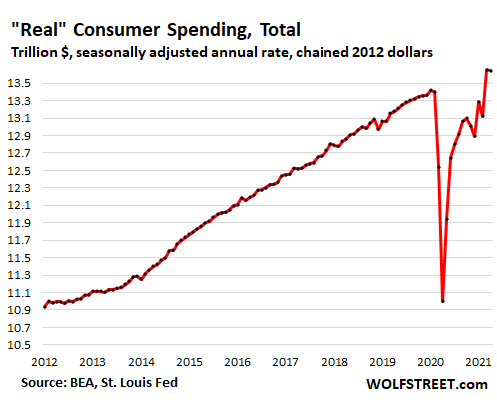

In complete, “real” shopper spending on all items and companies fell 0.1%, however not-adjusted for inflation, it rose 0.5%. You get the drift. Consumers spent much more cash to get even much less for it:

Everyone now has their very own laundry checklist of items and companies which have abruptly gotten much more costly, or the place the worth stayed the identical, however the items have reduced in size or the standard was lowered, or a mix. Astute customers have been reporting this for months, however in March and April, it started to noticeably present up within the knowledge.

Enjoy studying WOLF STREET and need to help it? Using advert blockers – I completely get why – however need to help the positioning? You can donate. I respect it immensely. Click on the beer and iced-tea mug to seek out out how:

Would you wish to be notified by way of electronic mail when WOLF STREET publishes a brand new article? Sign up right here.

![]()

Drone footage of roofs with aluminum and metal shingles. Take within the particulars of every set up from a hen’s eye view.

[ad_2]